BTC Price Prediction: Navigating Critical Juncture Amid Mixed Signals

#BTC

- Technical Support Test - BTC trading near Bollinger Band lower boundary at $109,198 with MACD showing potential momentum shift

- Miner Industry Transition - Major players pivoting to AI hosting and securing billion-dollar financing despite halving pressures

- Institutional Catalysts - Tether's fundraising efforts with SoftBank and Ark Invest indicating sustained institutional interest amid market volatility

BTC Price Prediction

BTC Technical Analysis: Critical Support Test Underway

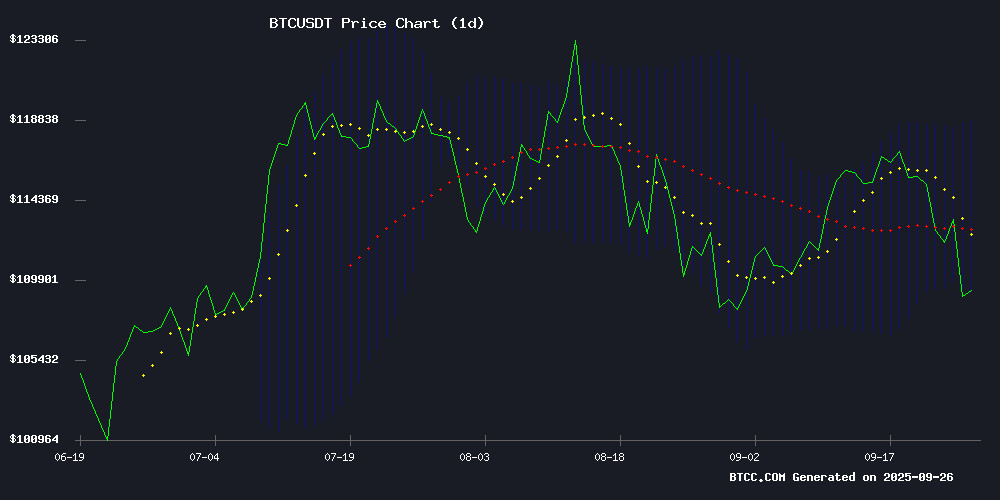

BTC is currently trading at $109,310.67, below its 20-day moving average of $113,993.97, indicating short-term bearish pressure. The MACD shows a negative reading of -523.66, though the histogram is positive at 1,400.28, suggesting potential momentum shift. Bollinger Bands position the price NEAR the lower band at $109,198.65, which now acts as crucial support.

According to BTCC financial analyst Michael, 'The current technical setup shows BTC testing key support levels. A hold above $109,200 could trigger a rebound toward the middle Bollinger Band around $114,000. However, breaking below this support might accelerate declines toward $105,000.'

Market Sentiment: Mixed Signals Amid Miner Transition and Profit-Taking

Recent news highlights Bitcoin miners pivoting to AI hosting as halving squeezes revenues, while TeraWulf secured $3 billion financing for expansion. However, Bitcoin hit 3-week lows as long-term holders took profits, and the market awaits Fed's response to PCE data matching expectations at 2.9%.

BTCC financial analyst Michael notes, 'The miner transition to AI and major financing deals show industry adaptation, but profit-taking and regulatory uncertainty create headwinds. The market sentiment remains cautiously optimistic despite recent pullbacks, with institutional interest continuing through players like Tether engaging SoftBank and Ark Invest.'

Factors Influencing BTC's Price

Bitcoin Miners Pivot to AI Hosting as Halving Squeezes Revenues

Bitcoin mining operators are diversifying revenue streams through long-term AI hosting contracts following April's halving event. Cipher Mining's $3 billion, 10-year deal with Fluidstack demonstrates how miners can monetize energy infrastructure without divesting assets. The transaction includes $1.4 billion in Google-backed financing, signaling institutional validation of the model.

TeraWulf's parallel MOVE to dedicate 200MW to AI workloads at Lake Mariner—potentially worth $3.7 billion—confirms a structural shift in mining economics. These agreements transform power contracts into balance sheet assets, creating predictable cash flows to offset volatile BTC rewards. The sector's evolution mirrors traditional utilities adapting to market pressures.

Bitcoin Miner TeraWulf Secures $3 Billion Financing for Google-Backed Data Center Expansion

TeraWulf, a Bitcoin mining firm transitioning into data center services, is finalizing a $3 billion debt financing package to expand its infrastructure. Morgan Stanley is leading the arrangement, with the deal potentially structured as high-yield bonds or Leveraged loans. Google is deeply involved, providing a $1.4 billion backstop, with total support potentially reaching $3.2 billion.

The company's shift from pure Bitcoin mining to diversified data center operations includes a 10-year colocation agreement with Fluidstack, valued at $3.7 billion in revenue. Market observers view this as a strategic pivot toward institutional-grade infrastructure partnerships.

Bitcoin Hits 3-Week Low as Long-Term Holders Take Profits

Bitcoin slumped to a three-week low of $108,652 amid aggressive profit-taking by long-term holders and waning ETF demand. The cryptocurrency now trades at $109,027, down 2.6% on the day and 6.44% for the week.

Post-FOMC rally Optimism faded quickly as LTHs realized 63.8k BTC in profits—the highest in three weeks. Glassnode data shows this cycle's long-term holders have locked in 3.4M BTC profits, exceeding previous cycles and signaling capital rotation.

The sell-side risk ratio for LTHs jumped to 0.0017, reflecting intensified distribution. Market recovery hinges on short-term holders absorbing the sell pressure to push BTC toward the $111k cost basis level.

U.S. Core PCE Matches Expectations at 2.9%, Bitcoin Awaits Fed's Next Move

The U.S. Core PCE Price Index, the Federal Reserve's preferred inflation metric, held steady at 2.9% year-over-year in August 2025, aligning perfectly with market expectations. The broader PCE index, including volatile food and energy components, rose 2.7% annually and 0.3% month-over-month, signaling persistent but moderating price pressures.

Market reactions have been mixed. While the data supports the Fed's recent 25-basis-point rate cut and fuels speculation of further easing, bitcoin faced immediate headwinds—tumbling 4% amid a strengthening dollar and over $1.5 billion in liquidations. Some analysts warn of deeper corrections, with targets as low as $93K, questioning whether August's $124K peak marked a cycle top.

Yet historical seasonality offers hope. With Q4 traditionally bullish for crypto, cooling inflation could reignite institutional interest. The Fed's balancing act between labor market focus and inflation control now becomes Bitcoin's pivotal variable.

Tether Engages SoftBank, Ark Investment in $500B Valuation Fundraising Push Amid IPO Speculation

Tether's ambitions for a record-breaking IPO gain credibility as Bloomberg reports advanced talks with SoftBank and Ark Investment. The stablecoin issuer seeks a $500 billion valuation—a figure first hinted at by CEO Paolo Ardoino when referencing "key investors" for strategic expansion across AI, energy, and commodity trading sectors.

The partnership pipeline appears robust: Tether and SoftBank already co-launched a Bitcoin investment vehicle in April 2025. Market observers note such alliances could validate Tether's transition from controversial stablecoin operator to diversified Web3 infrastructure player.

Bitcoin Price Watch: Critical Levels to Monitor Amid Market Pullback

Bitcoin's rally has faltered this week, with prices sliding below $110,000 after a cascade of long-position liquidations exceeding $1.5 billion. The cryptocurrency now trades 10% below its mid-August peak, forming a descending channel that signals cautious market sentiment.

Technical indicators reveal key support zones at $107,000 and $102,000—levels that could determine whether the correction deepens or stabilizes. Overhead resistance looms NEAR $117,000 and $123,000, price points that previously capped recovery attempts.

The 50-day moving average breach confirms weakening momentum, though the orderly nature of the decline suggests managed profit-taking rather than panic selling. Market participants await either a channel breakout or breakdown for directional confirmation.

AI Chatbots Disagree With Bearish Calls on Bitcoin’s Bull Run

Bitcoin's recent slide below $109,000 has sparked bearish sentiment, with critics like economist Peter Schiff suggesting the cryptocurrency has entered a bear market. However, AI models from ChatGPT and Grok argue this is a standard mid-cycle correction rather than the end of the bull run.

ChatGPT points to historical retracements during similar phases, noting the current pullback from ~$124K to ~$108K aligns with past patterns. The AI highlights continued accumulation by whales as a bullish signal, while identifying $95,000-$100,000 as a critical support level that WOULD indicate a true bear market if broken.

Grok, integrated into platform X, concurs that while the correction is substantial, the broader market cycle top may still be months away. Both AIs maintain that Bitcoin's long-term trajectory remains intact despite short-term volatility.

Bitcoin Bull Run Nears Critical Juncture as Analysts Debate Cycle Peak

Bitcoin's prolonged bull run shows signs of entering its final phase, with market analysts divided on whether the cryptocurrency is approaching its cycle peak. The current 2022-2025 trajectory mirrors historical patterns where BTC experienced its most dramatic surges just before completion.

Technical indicators reveal Bitcoin trading in an unusually tight 5% range between $110,500 and $116,000, suggesting heavy compression. Market analyst 'CRYPTOBIRD' notes this cycle has reached 97.5% of its standard duration since the November 2022 bottom, with the remaining 2.5% historically producing explosive price movements.

Russia's Crypto Trade Hits 1 Trillion Rubles as Kremlin Official Compares Bitcoin to Gold

Russia's cryptocurrency-facilitated trade volume surged to 1 trillion rubles in 2025, signaling mainstream adoption. Boris Titov, the Russian president's envoy for entrepreneur rights, declared cryptocurrencies have achieved parity with gold as a stable asset class during the crypto Summit 2025 in Moscow.

The $4 trillion crypto market capitalization now eclipses several European economies, with 650 million global holders. Institutional participation has transformed market dynamics, replacing retail speculation with disciplined investment strategies. "Volatility is declining along with excess returns, but investor confidence keeps growing," Titov observed.

Mining infrastructure is finding dual purpose in AI and big data processing during market downturns, creating new synergies. This technological symbiosis further stabilizes the crypto ecosystem, according to Kremlin officials.

Bitcoin Hard Fork Proposal Sparks Controversy Over Censorship

A leaked discussion reveals Bitcoin developer Luke Dashjr is considering a hard fork that would introduce a trusted committee to censor blockchain data. The proposal targets child sexual abuse material and non-monetary transactions like Ordinals and Runes—content some label as spam.

The move directly challenges Bitcoin's foundational principle of censorship resistance. It reignites tensions between Bitcoin Knots and Bitcoin CORE developers, who previously debated handling non-monetary transactions through technical adjustments rather than centralized oversight.

Market participants are watching closely. Any fork threatening Bitcoin's immutability could have cascading effects across exchanges and altcoins tied to BTC's ecosystem.

Leaked Chats Reveal Bitcoin Hard Fork Proposal Threatening Immutability

A leaked discussion involving Bitcoin Knots maintainer Luke Dashjr has sparked a governance firestorm, reviving tensions reminiscent of the SegWit2x era. The proposal outlines a hard fork introducing a trusted multisignature committee with retroactive blockchain alteration powers—ostensibly to remove illicit content like CSAM, cryptographically verified via zero-knowledge proofs.

Journalist L0la L33tz's report in The Rage frames the design as an existential threat: "This isn’t just protocol tweaking; it’s a permissioned overhaul." The leaked messages show Dashjr grappling with buried-state modifications to excise objectionable data, a move critics argue would shatter Bitcoin’s foundational immutability principle.

Market watchers brace for volatility as the debate reignites core ideological rifts. The mere suggestion of centralized intervention—even for noble causes—risks alienating decentralization purists while emboldening regulatory advocates.

How High Will BTC Price Go?

Based on current technical and fundamental analysis, BTC faces a critical juncture. The immediate resistance sits at the 20-day MA of $113,993, with stronger resistance at the upper Bollinger Band of $118,789. A successful break above these levels could target $125,000-$130,000 in the medium term.

| Scenario | Target Price | Probability |

|---|---|---|

| Bullish Breakout | $125,000-$130,000 | 35% |

| Range Bound | $109,000-$118,000 | 45% |

| Bearish Breakdown | $105,000-$100,000 | 20% |

BTCC financial analyst Michael suggests, 'The convergence of miner adaptation, institutional interest, and technical support creates a foundation for recovery, but Fed policy and profit-taking remain key variables. The $109,200 support level is crucial for maintaining bullish structure.'